What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves the exchange of one currency for another within the global market. This decentralized marketplace operates 24 hours a day, five days a week, making it the largest and most liquid financial market worldwide. It plays a pivotal role in international commerce, allowing businesses, governments, and speculators to buy, sell, and hedge currencies in response to fluctuations in exchange rates.

The fundamental concept of Forex trading revolves around currency pairs, which represent the value of one currency in relation to another. For instance, in the currency pair EUR/USD, the Euro is the base currency, while the U.S. Dollar is the quote currency. The exchange rate indicates how much of the quote currency is necessary to purchase one unit of the base currency. This pricing mechanism is crucial for traders, as they seek to profit from fluctuations in these exchange rates, whether through short-term trades or long-term investments.

Forex trading attracts a vast array of participants, including individual investors, corporations, financial institutions, and governments. Speculators often enter the market to capitalize on changing currency values, hoping to gain returns based on their predictive models of market behavior. Conversely, businesses utilize Forex trading to manage exposure to currency risk, ensuring that they can maintain stable costs when conducting cross-border transactions. Given its vast scale and influence, the Forex market not only sets the stage for currency trading but also acts as a barometer for global economic health.

Understanding the dynamics of Forex trading, including the interplay of currency pairs and the motivations behind trading activities, is essential for anyone looking to navigate this influential financial landscape.

Key Concepts and Terminology

Forex trading, or foreign exchange trading, is a complex yet fascinating field that requires a solid grasp of its key concepts and terminology. One of the foundational terms in Forex is the “pip,” which stands for “percentage in point.” A pip is the smallest price move in the currency pairs and is generally standardized as the fourth decimal place for most pairs. Understanding pips is crucial for measuring price movements and calculating potential profits or losses.

Another essential term is “lot,” which refers to the quantity of currency you trade. In Forex, a standard lot is typically 100,000 units of the base currency. Additionally, there are mini lots (10,000 units) and micro lots (1,000 units), allowing traders to scale their positions according to their risk appetite and capital. Knowing how to manage lot sizes effectively can greatly influence a trader’s strategy and exposure to risk.

“Leverage” and “margin” are also vital concepts in Forex trading. Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential gains and losses. For instance, a leverage ratio of 100:1 means that for every $1 deposited, a trader can control $100 worth of currency. However, high leverage comes with increased risk, making it essential for traders to understand their risk tolerance and use leverage prudently. Margin, on the other hand, is the deposit required to open and maintain a leveraged position, acting as collateral for the broker.

Lastly, the “spread” represents the difference between the bid and ask price of a currency pair, acting as a cost for entering a trade. Knowing how spreads work can help traders evaluate transaction costs when devising their trading strategies. By familiarizing themselves with these key terminologies, beginners can build a solid foundation for understanding Forex trading dynamics and making informed decisions in the market.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in Forex trading. It serves as a structured approach that guides traders through the complexities of the market, ultimately leading to more informed decision-making. Different trading strategies cater to various market conditions and individual trader preferences, including day trading, swing trading, and scalping.

Day trading involves executing multiple trades within a single day, capitalizing on short-term market fluctuations. This strategy requires a keen understanding of market trends and real-time analysis, demanding a significant time commitment from traders. Conversely, swing trading entails holding positions for a few days to several weeks to take advantage of expected price movements. This approach is suitable for those who cannot devote all day to trading but still wish to engage actively with the Forex market.

Scalping, on the other hand, is focused on making numerous small profits from minor price changes throughout the day. This method necessitates quick thinking and execution, often leveraging large amounts of trading volume to realize gains. Understanding which strategy best aligns with one’s goals and risk tolerance is critical for efficient trading.

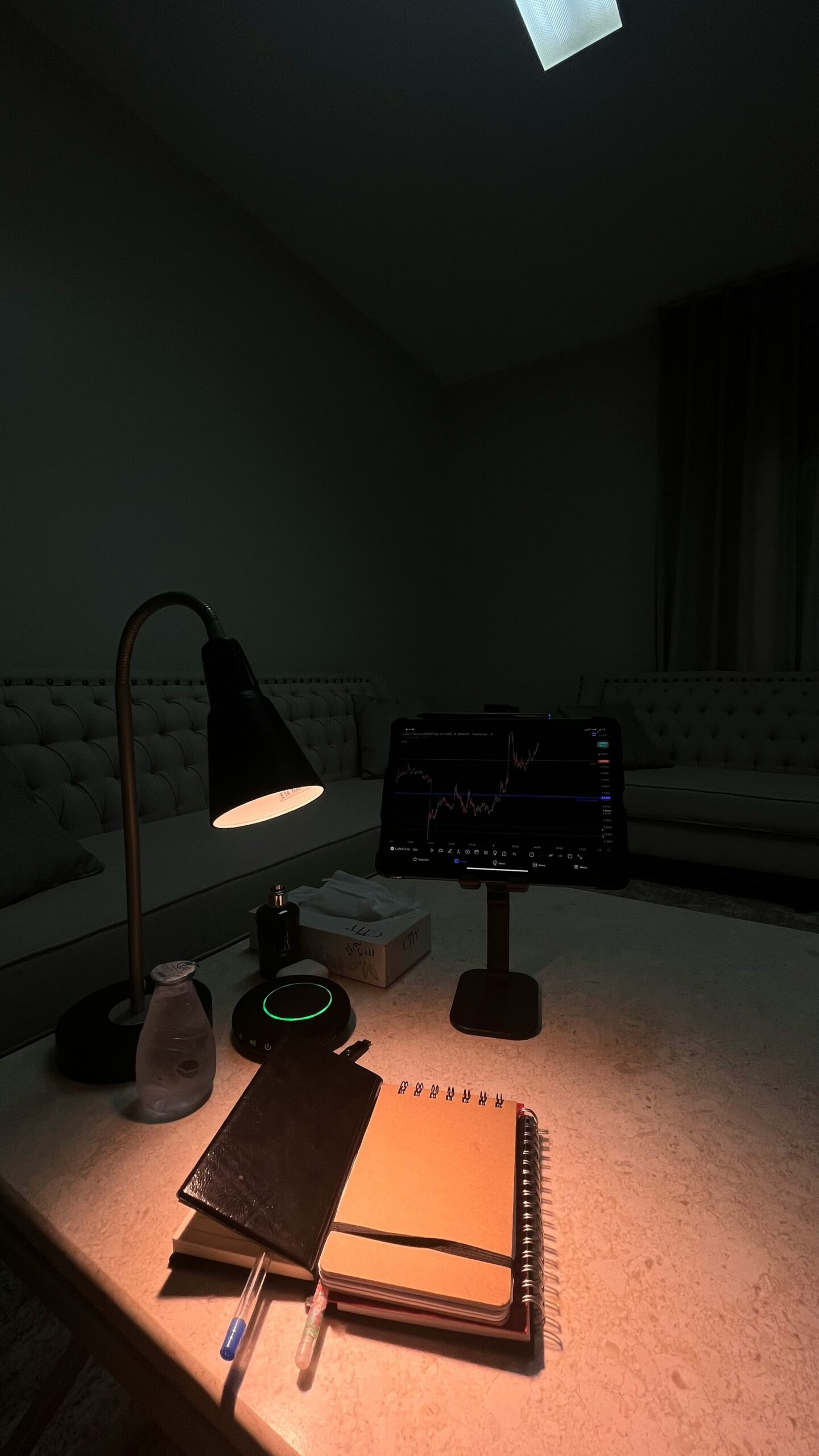

In addition to selecting a trading strategy, either technical or fundamental analysis forms the backbone of effective trading practices. Technical analysis, relying on charts and historical price patterns, enables traders to predict future market movements based on historical data. Conversely, fundamental analysis evaluates economic indicators, news events, and geopolitical developments, providing insights into market sentiment.

To develop a personalized trading approach, one should consider individual risk tolerance and trading objectives. This self-assessment allows traders to select strategies that harmonize with their comfort levels and financial aspirations. Ultimately, a tailored trading strategy not only enhances the odds of success in Forex trading but also fosters confidence in navigating the market’s complexities.

Choosing a Forex Broker and Trading Platform

When entering the world of forex trading, selecting the right broker and trading platform is a critical decision that can significantly impact your trading outcomes. A forex broker acts as an intermediary that provides traders access to the foreign exchange market, while the trading platform is the software that facilitates trade execution and analysis. Therefore, understanding how to evaluate potential brokers and platforms is essential.

One of the foremost factors to consider is regulation. A reputable forex broker should be regulated by a recognized financial authority, which ensures that they adhere to strict guidelines and standards, thus providing a level of security for your funds. This means looking for brokers regulated by entities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the United States. Regulations help protect traders from fraud and ensure a fair trading environment.

Additionally, examine trading fees as they can vary significantly among brokers. These fees might include spreads, commissions, and withdrawal fees. Understanding the overall cost of trading can help you make informed decisions that align with your budget and trading strategy. Furthermore, the usability of the trading platform is crucial. Look for a platform that is user-friendly, with intuitive navigation and access to essential tools, such as charting software and analytical resources.

Educational resources and customer support should not be overlooked. A good broker will offer a variety of educational materials, including webinars, articles, and tutorials, to aid your understanding of forex trading. Reliable customer support is equally important; verify the availability of support through multiple channels, such as live chat or phone, to resolve issues promptly. Before committing real capital, consider setting up a demo account with potential brokers. This will allow you to experiment with trading strategies and familiarize yourself with their platforms without financial risk.